Tech Thoughts Newsletter – 21 April 2023.

Market: Results season kicked off in earnest this week. Within the portfolio we had ASML, LAM Research and TSMC all reporting. While LAM Research and TSMC both issued June quarter guidance below expectations, both shares rallied on the day around management commentary that the cycle (memory and semis more broadly) is close to a bottom. Equity markets – and tech especially – are generally quite sophisticated around buying the last cycle downgrade/cut and that was certainly the mood this week.

Portfolio: We added more Adobe and Infineon to the portfolio. We also sold our SAP position as it has traded strongly and we see limited upside now after the rally.

Semis was the focus for us this week. We go into more details on each of the individual company reports below but for us there are 3 key takes for the broad sector we want to highlight:

- TSMC keeping its capex guide unchanged – tech leadership battle is on

For us going into TSMC results, one of the most important factors was always going to be what they did with their capex. Rumours had been circulating in the Taiwanese local press that it would be cut – and indeed as a team we definitely thought a cut was possible, given the ongoing inventory correction across the sector. In fact they didn’t – they reiterated their prior $32-36bn guide – and having spent $9.95bn in Q1 are actually tracking at a much higher level.

It’s important not only because they are the biggest capex spender and so in most cases the biggest customer of our semi cap equipment companies, but also because we think it will drive investment and spend across the industry. TSMC continuing its spending (just as it did through the 2008/2009 downturn) and continuing to move capacity to more advanced nodes means that, from a survival perspective, Intel and Samsung both need to do the same, or risk falling out of the market completely.

We learnt from ASML management this week that TSMC have more than 100 EUV tools; we think Samsung has 40-50 (across logic and memory) and Intel we think has just 1 EUV tool in production. Samsung and Intel’s ability to compete is totally dependent on them building up leading edge fabs and adopting EUV/High NA – which are already in ASML’s order books. It’s an extraordinary level of catch up required – and we think that will be a significant driver of orders for the next 2-3 years.

For us and our large overweight in semicap equipment it’s good news, and we think ASML especially will benefit (we go into more detail on ASML’s results and our meeting with management below).

- China spending at the trailing edge

Both ASML and LAM commented on the strength in spend coming from China building out mature/trailing node technology. This from ASML CEO Peter Wennink on demand coming from China:

“In my latest trip to China, I spoke to many customers and also to some end customers and the expansion plans, especially when it comes to issues like the EV transition, when it comes to the rollout of the communication networks, when you talk about the energy transition, that’s all in that mid-critical to mature domain and the number of end products that they are planning to produce is significant and the semiconductor capacity base to support that is not there yet. It’s being built. And this is why I think it’s sustainable.

I think, we’re underestimating. I can sound like a broken — like a broken record, I suppose. I think, all underestimating the end demand for mature and mid-critical semiconductors. The application space for those semiconductors is so wide and every time — you could say, well, I’m biased, because I’ve been there now very recently and I talk to those customers and those end customers, but I’m convinced that that is needed.

And so, I think, it’s very sustainable. Also, when I look at the expansion plans in the major centers in China, whether it’s Beijing or Shanghai or Shenzhen, those fabs will be there. The end markets are there and it’s going to be a lot of China for China.”

While US export controls are preventing China from receiving leading edge machines, they can still receive equipment to build out trailing or more mature node technology. Our view is that it makes a lot of sense for China to try to build up a very strategic position in trailing edge semis. The reality is that there is a structural supply shortage in trailing edge globally; these trailing edge semis are critical (in autos, industrial) – that was clearly borne out by the shortage during the pandemic; and it is only really TSMC who have meaningful supply outside of China (Global Foundries is still relatively small in terms of capacity). It’s also an area the US has – and continues to (even with the CHIPS act) – bizarrely ignore, after Intel sold off or reused most of its trailing edge fabs decades ago. China building up critical supply not only for its domestic demand but also which the US needs for products US consumers buy – will put them in a powerful strategic position. We believe China will continue to spend and continue to be a big contributor to semicap equipment revenue for the next several years.

- LAM Research showing resilience of tech in the current cycle

LAM Research’s results for us demonstrated the resiliency of the business in the face of a quite brutal memory-led downturn, where LAM is especially exposed. Despite the memory weakness feeding through to lower revenues, LAM still generated $1.6bn free cash flow in the quarter – a record high. LAM’s ability to execute cost control and cash generation in the face of an industry downturn is impressive and we think we’ll see it reflected across many of the businesses we own (across semis and across tech more broadly).

The advantage tech has is typically high gross margins which give it an ability as a sector to flexibly manage its cost base – the fact that we’re seeing that in one of the most historically cyclical parts of tech (semicap equipment) is quite extraordinary.

In what we think will be its trough, next quarter, LAM will report EPS of ~$5. That means that in one of the worst memory downturns in history, LAM is trading <25x trough earnings (even after the share price rally this week).

For context, LAM lost money back in 2008/2009 – these businesses are really proving themselves to be much more resilient in the face of a downturn than they have ever been, in what is a structural growth industry.

Onto individual company results:

TSMC results – longer inventory correction assumed

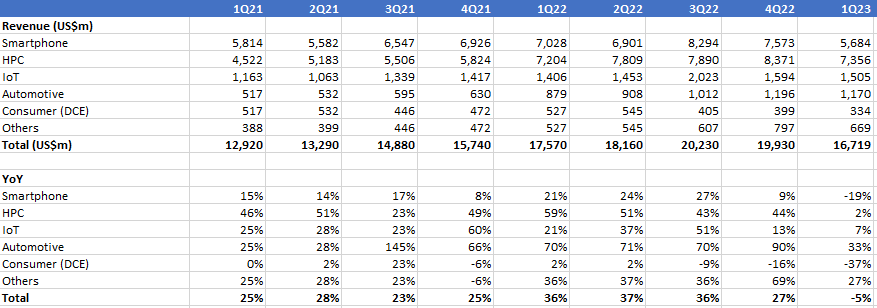

- Every quarter one of the most important events for us in tech is TSMC’s report and earnings call. It’s at the heart of the semi ecosystem and touches almost every end market – smartphone, PC, datacentre, auto – we show our estimates of the yr/yr growth rates for each of its divisions in the table below.

- TSMC guided down its revenue expectations for the full year, now expecting revenue to decline low to mid single digit (where they had previously expected small growth)

- The main culprit here is the inventory digestion which taking longer than they expected – now expected to extend into Q3.

- The reality is that the inventory situation across the supply chain is evidently much worse, with much more to work through, than anyone thought at the start of the year – TSMC just can’t get away from that.

- In the context of a tough industry backdrop though, TSMC’s business model remains resilient (just as with LAM Research) – they have done a decent job of cost control and continue to deliver robust margins.

- For the equity markets and driving the upwards share price reaction on the day, key on the call was founder CC Wei’s comment that “we believe we are passing through the bottom of the cycle of TSMC business in the second quarter”

- As we said above, tech investors are accustomed to cyclical businesses and buying the last cut – the fact is that semis businesses have been remarkably resilient from a returns perspective this downcycle. Looking through the short term, the structural growth of the industry – driven by cloud, AI, auto – is all very positive for longer term growth.

- In the end market details, for us the standout surprise was smartphone revenue down 27% qtr/qtr in Q1 – we’ve been quite bearish on PC/smartphone related demand but even for us this was much weaker than we had anticipated. Given the mismatch between Mediatek (which we think is ~20% of TSMC’s smartphone revenue) and TSMC (Mediatek’s -12% qtr/qtr decline was much more muted) we wonder what is happening at Apple (~40% of TSMC’s smartphone revenue). It may be end demand weakness (though the latest Apple data out of China suggests that market is still robust) or it may be related to inventory digestion specifically in the Apple supply chain – we continue to keep this in mind going into Apple results this quarter.

- We think Q1 may mark the bottom of Android smartphones; Mediatek, which is our best read on the Android ecosystem, saw March volumes up significantly month on month.

- Auto was up ~30% yr/yr at TSMC, and while they commented that they expected some softening, we’re more confident the market should hold up (and that what TSMC is seeing is volume shifting to new capacity build built at the IDMs), given still strong backlogs for NXP and Infineon which we hold. HPC also showing growth (TSMC’s HPC number includes PC exposure, so we think datacentre demand is holding up relatively well).

- TSMC reiterated their previous statement that N3 demand will exceed supply and will make up mid-single digits of full year 2023 revenue; we can see the technology transitions and products coming down the pipe – from AMD, Nvidia – and expect 3nm could be a very large (and therefore highly profitable) node.

Portfolio view: Overall TSMC’s formula of outperforming the semis market and foundry is still working, and they’re managing their business well in terms of cost control, but there’s no escaping the inventory digestion for the whole industry is taking longer. 14x 2023 EPS discounts that, and growth will resume in 2024.

ASML – still seeing strong demand, order book normalising

- ASML beat consensus expectations for Q1 and guided ahead for Q2. On the day, the market was slightly put off by the forward looking order number of €3.8bn, which was lower than we’ve seen in recent quarters (Q4 was €6.3bn)

- For us, the lower order number isn’t concerning – the backlog is still €39bn – that’s about two times the system sales that will be recorded as revenue this year. Customers have orders in the book, far exceeding ASML’s ability to supply and covering shipments extending well beyond order lead times. In that environment it makes sense for customers to pause slightly (and €3.9bn in the context of history is still a strong order number).

- Supply is still very much exceeding demand and any push outs that are happening at some players (we think there has been some adjustment) are being filled by others;

- Mature nodes still seeing high demand – one of the best reads ASML has on the industry is their equipment utilisation. They can see from their system data how well utilised their machines are, and it’s always a good data point.

- One of the things they talk about in this set of results is the still high demand they’re seeing at mature node logic which we think is around the auto/industrial space where we remain exposed via Infineon, NXP and ADI.

- As above one of the particular points worth highlighting is management talking up mature node spend from China domestic customers – we definitely still think China will spend to build capacity at the trailing edge which still puts them in a great strategic position in semis, despite being limited at the leading edge.

- In separate but related news in the semicap space, the European Union finalised its Chips Act on Tuesday giving it a total value of €45bn to attract local production of semiconductors. Intel and TSMC are both thinking about building factories in Europe while both Infineon and STM have just started building new factories – all good news

Portfolio view: Our view is still that ASML will continue to deliver outsized growth and returns within the semis sector – it remains a core position in the portfolio.

LAM Research beat but lower June guide – look through short term weakness to long term growth

- Key takes for us are covered in the most part in our comments above on resilience, but a few more details from results:

- The March quarter beat revenue expectations but the June quarter much worse $3.1bn vs cons $3.5bn.

- Memory spend levels are the lowest in a decade and June is still going lower. Like TSMC, management did seem to really want to say June was a bottom in terms of $ value – with comments that the current spend level is unsustainably low and utilisation levels as low as they could ever remember.

- At the same time there are clear structural growth trends that will support it long term – from the call:

“Memory spending in 2023 is at a historic low as a percentage of total WFE. We believe this level of investment is unsustainable to support long-term growth in bit demand, especially considering the data-intensive applications such as AI, are still in the early stages of adoption and can have approximately 3x the DRAM and 8x the storage content of a regular server. In addition, advances in memory architectures such as DDR5 are driving process technology evolution and larger die sizes.”

- As with ASML and as we commented above, they are seeing strong demand in China trailing edge logic. The US export impact is less than expected and we believe comments around its deferred revenue and prepayments mean that there are some new Chinese players in the order book. It supports the view that China are still spending to be a strategic source of trailing edge semis

Portfolio view: the memory weakness is worse than we expected for June (and we expected it to be bad), but with that is also a sense that really memory investment will struggle to fall further from the June levels LAM are guiding to and that all leads us closer to the last cut.

For us it’s all about owning resilient business models and LAM is proving itself to be that. Doing the maths around where earnings can get to in a recovery/upcycle scenario (which can happen given that underlying structural growth in memory content) can easily get us to LAM trading on close to 10x earnings – it remains a core holding for us.

Netflix’s ad tier delivering, but still question-marks on the attractiveness of streaming return on investment

- Netflix (not owned) reported so so results – subscriber growth is slowing and the company has taken steps to try to fuel revenue growth through limiting password sharing and launching its ad-tier

- The details around the ad tier business were the most interesting for us in the results – and it does look like so far it’s going very well.

- The ads plan in the US has a total “ARPU” (subscription plus ads) is higher than the basic plan. That means that the initial concern that the ads tier would cannibalise the standard plan offering is not a concern at all – in reality, Netflix should want its subscribers to move to the ad plan and it will all be accretive to revenue.

- It’s clearly still early days in the ads business (typically new platforms will see strong “testing” demand and the question is can CPMs stay where they are?) but definitely initially good news

Portfolio view: we don’t own Netflix – while we recognise they have done a good job of getting to profitability and the ads pivot looks to have been a good financial decision, we still struggle to justify its valuation – it grew its revenue 4% this quarter and trades at over 30x earnings…

Broadly we still question the long term attractiveness of streaming as a business, and the concerns around continued competition for content. We own Disney which we view as more differentiated with more optionality around its content and ESPN, trading at more attractive valuation levels. It also launched its ad tier within its streaming business and Netflix’s results may suggest that could be more accretive to revenue than we might have initially thought.

Tesla price cuts again

- We spoke last week about the price war in electric vehicles, particularly in China, where the sheer number of competitors (300+) emerging continues to astound us.

- Tesla cut prices again this week, ahead of its results. Its results then showed the implications of the aggressive pricing strategy – a shrinking operating margin.

- We expect continued aggressive pricing in the sector and that’s one of the reasons we avoid owning any auto OEMs, with Tesla the one we’re most often asked about.

- While we absolutely believe the world will shift to EV and that Tesla can sell many cars and make large amounts of revenue, we don’t believe that it will make a sustainable level of profit and returns that could justify the valuation.

- We think the barriers to entry in an EV world are even lower than the traditional combustion engine market, which has historically been a difficult industry in which to make a sustainably high return.

- That said, reducing EV prices and stimulating demand for EVs is certainly a positive for the semi suppliers, where (unlike auto OEMs) they have pricing power that enable them to make a sustainable return on invested capital.

Portfolio view – We continue to hold Infineon and NXP where we see their autos businesses remaining largely sold out into 2023 – they benefit from the increased semiconductor content in EV vs ICE. We don’t invest in any Electric Vehicle/auto manufacturers.

China GDP stronger than expected

- Last we spoke about the idea that a big amount of the uncertainty as it relates to consumer end markets and particularly important for semis.

- This week China released Q1 GDP growth accelerating to 4.5% yr/yr (Q422: 2.9%), stronger than expected. Retail sales grew 10.6% in March vs 3.5% in Jan-Feb, admittedly helped by the easy comp, but certainly in the right direction.

- Worth noting for our EV semis, auto sales in China (where EV penetration very definitely leads the world) were particularly strong +11.5% in March, having declined 9.4% yr/yr in Jan-Feb

Portfolio view: as we’ve commented before, we’ve tried to limit our exposure to consumer demand (where China is a very important factor) for the past several quarters. Definitely a positive sign here and one to watch but the shape of the recovery remains uncertain and for now we continue to concentrate the portfolio on end demand with more visibility (EV, cloud)

Telecom equipment – inventory management at telecom operators

- Last week we wrote about the profit warning of Adtran (not owned) as broadband operators were scaling back somewhat on investments and reducing their inventory levels.

- Ericsson (not owned) and Nokia (not owned) reported better than expected 1Q sales and margins in their mobile networking business. 1Q sales was helped by strong demand in South East Asia and India where the competition is high and margins low.

- The negative news is however that both companies are stating that 2Q will be hurt by inventory corrections by the telecom operators. This means that sales that are normally up 10% Q/Q will be flattish and we will see limited margin improvement.

Portfolio view: We expect that the effects of the inventory corrections from telecom operators also will have a negative effect on the carrier business of Cisco (owned). We expect however the strong datacenter business to compensate.

Gaming – NPD numbers show continued weakness but PS5 still winning on hardware

- US sales of videogames in March fell by 7% year-over-year, according to Circana/NPD – so the weakness continues, especially for March as we lapped a strong 2022 release schedule

- Hardware sales (much smaller than software) is holding up better – up 10%, with PlayStation 5 retaining its top spot in terms of both unit and dollar sales.

- Xbox Series and Nintendo Switch followed in second place for dollar terms and units sold respectively.

Portfolio view: Sony still good news for AMD as the sole supplier. More broadly we try to limit our gaming exposure in the current hiatus of new releases…

For weekly insights on the latest market updates, please subscribe to our Tech Thoughts podcast.

For more information about the latest trends and forecasts, please visit our official Tech Thoughts page.

We provide investors with access to category leading technology companies, globally. Our assets under management have a total value of more than $1bn, and our limited partners include institutions, family offices and entrepreneurs. Learn more about our funds here.

Enquiries

For enquiries, please contact:

Inge Heydorn, Partner, at inge.heydorn@gpbullhound.com

Jenny Hardy, Portfolio Manager, at jenny.hardy@gpbullhound.com

Nejla-Selma Salkovic, Analyst, at nejla-selma.salkovic@gpbullhound.com

About GP Bullhound

GP Bullhound is a leading technology advisory and investment firm, providing transaction advice and capital to the world’s best entrepreneurs and founders. Founded in 1999 in London and Menlo Park, the firm today has 13 offices spanning Europe, the US and Asia. For more information, please visit www.gpbullhound.com.