2024 Allstar Awards Winners Announced!

We are thrilled to announce the winners of the 2024 Allstar Awards, where we celebrated the exceptional talent and innovation shaping the European tech landscape. The event brought together over 350 leaders from the global technology sector – including founders, investors, and leading voices – to honour another year of remarkable achievements.

Spanning 11 categories, from Entrepreneur of the Year to Growth & Buyout Fund of the Year:, the awards showcased the breadth of talent and forward-thinking vision within European technology today. The evening also featured a keynote address delivered by tennis champion, entrepreneur, and best-selling author Venus Williams.

A huge thank you to everyone who joined us and made this night so special. Your energy and support brought the event to life and made it an unforgettable celebration of innovation.

Congratulations to all the outstanding companies and individuals recognised for their achievements. Your contributions are driving the future of tech in Europe, and we are proud to celebrate your success!

Winners of the 2024 Allstars Awards

Allstars Shortlist 2024

We are proud to reveal the 2024 shortlist of the 22nd Allstars Awards.

EXIT OF THE YEAR

ENTREPRENEUR OF THE YEAR

GROWTH & BUYOUT FUND OF THE YEAR

INVESTOR OF THE YEAR

YOUNG ENTREPRENEUR OF THE YEAR

VC OF THE YEAR

TECH4GOOD

ALLSTAR COMPANY CHALLENGE

SERVICE PROVIDER OF THE YEAR

DIGITAL INNOVATION IN ART

2024 Categories

Partner – GP Bullhound

Alexis has broad experience across the technology industry and has led successful M&A transactions in sectors including software, IT services, telecoms, internet and digital media.

Prior to joining GP Bullhound, Alexis was Director of corporate development at Experian where he was responsible for deal origination and execution for the EMEA region. He previously spent more than 10 years working in the technology sector and held international Corporate Development roles at HP Enterprise Services and EDS, where he worked on numerous acquisitions and divestments across Europe.

Alexis holds a BSc Joint Hons. in International Management and Modern Languages from the University of Bath and an MBA from Imperial College Business School.

Partner – GP Bullhound

Alon is a Partner at GP Bullhound’s growth fund, responsible for originating investment opportunities and handling portfolio companies globally.

Prior to GP Bullhound, Alon worked at Silver Lake Partners, Atomico and Bank of America Merrill Lynch.

Alon graduated from the London School of Economics with a First Class Honours.

Anna is a seasoned entrepreneur and investor who has dedicated the last decade to investing in and partnering category-defining consumer brands. Accomplished CEO and financial leader, Anna established her own growth equity funds, with a specialist focus on wellness, beauty, and conscious lifestyle companies, to become a leading source of capital in the space.

Anna is Founding and Managing Partner of Vaultier7, an investment fund dedicated to partnering high growth consumer brands across UK, Europe and the US. Prior to that, Anna founded her predecessor fund Sloane Point Partners, dedicated to the same. Anna continues to manage both funds and has held more than 15 board seats across her global portfolio. Anna’s investments have included Axel Arigato, Aurelia London, DeMellier, 111Skin, Gisou, Little Spoon and Vestiaire Collective, to name just a few.

Anna was previously CEO at British Luxury Brand LINLEY and led the company through a sale. Prior to that Anna spent several years in financial markets in CFO roles and is a qualified Chartered Accountant having begun her career at PricewaterhouseCoopers.

Anna is also a Founding Patron of the British Fashion Council Foundation which focuses on education, grants and business mentoring to promote the art and business of fashion.

Partner – EQT

Carolina joined EQT Partners in June 2020, based in London, where she is a part of the Growth team that partners with growth stage companies and management teams.

Prior to EQT, Carolina was a Partner at Softbank Vision Fund, where she invested in Growth stage companies globally, and prior to that, Carolina invested at Series A and B as a Partner at Atomico. Some of her recent investments include Behavox, Gympass, Hinge Health, Rekki, Ontruck, Memphis Meats and Farmdrop.

Previously, Carolina has worked as Head of Ops to a now defunct gifting e-commerce start-up, as an investor at Chicago-based private equity firm Madison Dearborn Partners and within Consumer/Retail Investment Banking at Merrill Lynch in New York.

Carolina has a Bachelor of Science degree in Foreign Service from Georgetown University and an MBA from Columbia Business School. She is originally from Brazil.

Partner – Orrick

Chris Grew, a partner in Orrick’s London office, is a member of the Technology Companies Group, which advises high growth technology companies and venture capital firms. Chris joined Orrick in 2008.

Chris advises technology companies in venture capital transactions, public offerings and cross-border mergers and acquisitions. He regularly advises high technology (particularly Internet and computer software and hardware) companies with respect to their international business operations and transactions, as well as investment banks, venture capital firms and other financial intermediaries that serve technology companies

David is a partner and the head of Venture Capital at Marriott Harrison, responsible for the delivery of strategic leadership and advice to the firm’s client base of top-tier European and US investors and high growth companies.

Recognised as a leading UK venture capital specialist, David is a regular speaker, commentator and contributor to key industry events and publications and a member of the BVCA committee for early-stage investment model documents.

Partner and Co-President

Deep Shah is a Partner and Co-President of Francisco Partners, and is based in the firm’s London office where he jointly leads European investment activities as well as managing the investment team operations globally. Prior to joining Francisco Partners in 2003, Deep held a range of roles at Morgan Stanley within both their Investment Banking and Private Equity groups. Deep currently serves on the board of directors of BluJay Solutions, ByBox, EG Software and MetaSwitch Networks. He previously served on the board of Attenti, Click Software, C-MAC MicroTechnology, eFront, Ex Libris, Lumata, Masternaut, NexTraq, Operative, Prometheus Group and Smartfocus while being involved in a number of the firms other investments.

Partner – AlbionVC

Ed is a Partner at AlbionVC where he leads the tech investing, focusing on early stage software and deeptech investments.

Aside from investing Ed also plays keyboard in the Allstars band. Ed started his career at ING Barings, working with public companies during the dotcom boom and bust”.

George Coelho is Co-Founder of Astanor Ventures, an investment manager specialized in FoodTech venture finance. Previously he was Chairman of Octo Telematics, Ltd. Coelho also co-founded the European arm of Benchmark Capital, now known as Balderton Capital, a leading venture capital firm. Before Benchmark, he was a founder of Intel Capital, the strategic venture capital arm of Intel Corporation.

Coelho has wide investment experience ranging from early-stage start-ups to public companies and has been involved in more than 100 investments worldwide. Sample transactions where he has been an early investor include: Broadcom and Citrix (US), PCCW (China), Trend Micro (Japan) and Betfair, LoveFilm and ZOPA (UK). Coelho has successfully brought companies to flotation on stock exchanges throughout the world, which today represent over $100 Billion in market capitalization.

Coelho holds a B.S. from The American University and an MBA from The George Washington University. He has been a Trustee of The George Washington University (2008-2016) and was on the Council of the School of Business and The Corcoran School of the Arts & Design. Currently he is on the Board of Human Rights Watch and The American Air Museum in Britain. He is also a lifetime Fellow of the RSA. In 2011 he was awarded the Polish State medal, Pro Memoria.

Kerry co-founded IQ Capital in 2006 and is one of the UK’s most experienced VC investors with over 20 years deep-tech venture capital experience. She joined Venture Technologies in 1998, investing in the first wave of UK deep-tech companies and has focussed on deep tech early-stage technology over her five funds which invest from seed to £30m to portfolio outperformers.

Kerry specialises in GTM, Strategic Marketing, Competitive Intelligence and heads up IQ’s cybersecurity, supervisory and reg tech, big data and neuro-tech portfolio. She sits on several boards and has conducted several exits and IPOs.

She is known as a contributor to best practice in venture capital, from ESG and a 2018 in-depth study on Investment Committee best practice and decision making across Private Equity and Venture Capital. She is the Chair of the British Private Equity and Venture Capital Association (BVCA), a Fellow in Entrepreneurship at the University of Cambridge (Judge Business School) and Board Advisor to All Party Parliamentary Group for Entrepreneurship.

Co-Founder and Managing Partner – GP Bullhound

Manish Madhvani is Co-Founder and Managing Partner of GP Bullhound. Manish has executed M&A and capital raising transactions since 1997, involving some of the best known global internet, software and media companies, including: Spotify, King.com, Believe Digital, WPP, Wipro, Fjord, Hearst Corporation, Accenture, Newscorp and Experian.

Manish who was selected as one of the top 40 dealmakers globally by M&A Advisor, started his career at Barclays Capital’s Private Equity team. He has advised the Treasury on Entrepreneurship and graduated from Southampton University with an LLB in Law / MA in Marketing.

Manish is a regular speaker on Bloomberg and CNBC and is currently an Ambassador for London Technology Week. He was recognised as one of the leading Entrepreneurs in the UK by the Sunday Times / Maserati 100.

Matthew is the Managing Partner and CEO of Hg, a leading investor in European and transatlantic software and services businesses.

Matthew leads Hg, day-to-day, with a focus on the Mercury and Genesis funds. He is also Chair of the Investment Committees and is a member of the Board.

Joining Hg in 2010, Matthew led the creation of the Mercury funds before taking on his current role in 2018. He has acted across many of the investments in the Mercury and Genesis funds. Prior to joining Hg, Matthew was a Partner at Apax Partners.

With a vast European network and strong presence across North America, Hg’s 400 employees and $65 billion in funds under management support a portfolio of around 50 businesses, worth over $130 billion aggregate enterprise value, with over 100,000 employees, consistently growing revenues at more than 20%.

As a lapsed engineer, my passion has always been building, which now translates into building businesses. Businesses that delight their customers, scale and add jobs over the long term. My greatest delight comes from witnessing the range of successful companies that we have built and working with the leaders that built them.

Partner – TCV

Mike is a Partner in TCV’s London office and has been with the firm for 8 years. He splits his time between SaaS, fin tech and consumer technology. His current investments include Revolut, Redis, Qonto, Trade Republic, Believe (Euronext Paris: BLV), Miro, Mambu, FlixMobility, SuperVista, Sportradar (Nasdaq: SRAD).

Omri Benayoun is General Partner at Partech, responsible for the Growth fund. He joined in May 2014.

He currently sits on the boards of Brandwatch, EcoVadis, NA-KD, Evaneos, Rohlik and UrbanSportsClub.

Before joining Partech, Omri had senior executive positions at worldwide retail leader Casino Group: he joined the executive committee in 2010 as EVP Corporate Planning and Strategy and in 2012, he was promoted to Deputy CEO at Cdiscount.com, the #3 eCommerce player in Europe and #1 in France. Omri also worked for Dassault Systemes, where he led Corporate development department for the worldwide leader in Product Lifecycle Management software from 2007 to 2010. He started his career, from 2002 to 2007, as a high-level civil servant at the Ministry of Economy, where he implemented government programs for start-ups and SMEs.

Omri holds a Master’s Degree in Sciences from the Ecole Polytechnique summa cum laude and is an alumnus of the post graduate Corps des Mines program.

Partner – Connect Ventures

Rory is a Partner at Connect Ventures, a thesis-led venture capital firm based in London and investing across Europe. Connect leads seed investments in purpose-led founders, obsessed with solving hard problems at scale, by creating products and companies that people love. Rory is passionate about technology, entrepreneurship and leadership development, and has spent the majority of his career working in start-ups and venture capital. Prior to Connect he was a partner at MMC Ventures and a co-founding partner at BGF Ventures. He’s invested at seed, series A and series B stage, in both B2B and consumer software companies. He now spends most of his learning and investing in fintech.

Partner – Wilson Sonsini Goodrich & Rosati

Stacy Kim is a leading American cross-border technology lawyer, strategic business advisor, and a co-founding partner of Wilson Sonsini Goodrich & Rosati’s London office.

Stacy advises technology and life sciences companies at all stages of the corporate life cycle (including formation, U.S. “flips,” financings, collaboration/joint ventures, and exits); and leverages the Wilson Sonsini platform to help companies and investors compete and win on the global stage. She supports companies in diverse industries such as agritech, AI, digital media, fintech, IOT, life sciences, semiconductor, and software, as well as the venture capital firms that invest in these companies.

Stacy is passionate about advancing women in technology in the UK by collaborating with and sponsoring certain events, including her mentorship activities with Blooming Founders and Declare.

Rupert specialises in advising ultra/high net worth private clients and their families with a client focus on entrepreneurs. He has also worked at JP Morgan and Berenberg.

Educated at Cambridge University, The Royal Military Academy Sandhurst, he was a British Army Officer for 16 years before entering financial services.

Premium Sponsors

LGT Wealth Management UK is part of the global private banking and asset management group LGT, owned by the Princely Family of Liechtenstein. When we set up our business in 2008, our aim was to offer a fresh approach to wealth management. We put our clients first by providing a transparent service, designed around what is right for each of them.

Our entrepreneurial approach, together with the wider LGT Group’s stability, enables us to make decisions that we believe will provide long-term benefits for our clients. This flexibility allows us to tailor our business model to suit our vast range of client types and the unique requirements that they have, be it private clients, institutional clients, financial intermediaries or international clients.

Marriott Harrison is a legal transactional and advisory firm, best known for its market-leading work alongside ambitious entrepreneurs and insightful investors who build, evolve, and monetise globally successful companies. From its base in London, its multi-disciplinary team manages transatlantic and pan European work, often involving the world’s top-tier technology investors.

Orrick is a global law firm focused on serving three sectors driving the global economy: technology & innovation, energy & infrastructure and finance. Founded more than 150 years ago in San Francisco, Orrick today has offices in 25+ markets worldwide. Innovation inspires us. That’s why Financial Times selected Orrick as the Most Innovative Law Firm in North America for a remarkable three years in a row. Fortune ranks Orrick in its 2020 list of the 100 Best Companies to Work For (five years in a row) and Law360 ranks us in its Global 20 list (eight years in a row).

Wilson Sonsini Goodrich & Rosati is the premier legal advisor to technology, life sciences, and other growth enterprises worldwide. We represent companies at every stage of development, from entrepreneurial start-ups to multibillion-dollar global corporations, as well as the venture firms, private equity firms, and investment banks that finance and advise them.

Awards Sponsors

.ART is the internet domain for the world’s art and creative community. Launched in 2016, .ART is one of the fastest-growing top-level domains for creatives, with more than 250,000 domains registered to date. In 2019, .ART launched “Digital Twin” to securely archive art and cultural object metadata. As part of the company’s ongoing philanthropic activities, a portion of .ART’s revenue goes to support the charitable Art Therapy Initiative. .ART’s global team across London, Beijing, Los Angeles, and Washington D.C. shares the mission to bring technology and art together, creating a digital infrastructure for the international creative community.

For more information, visit www.art.art.

As one of one of the premier firms for venture capital transactions Taylor Wessing act for many of the most high profile investors – from the prominent early stage funds and the biggest international venture capital firms to corporate investors and sovereign wealth funds –as well as many of the most successful early and growth stage investee companies across Europe.

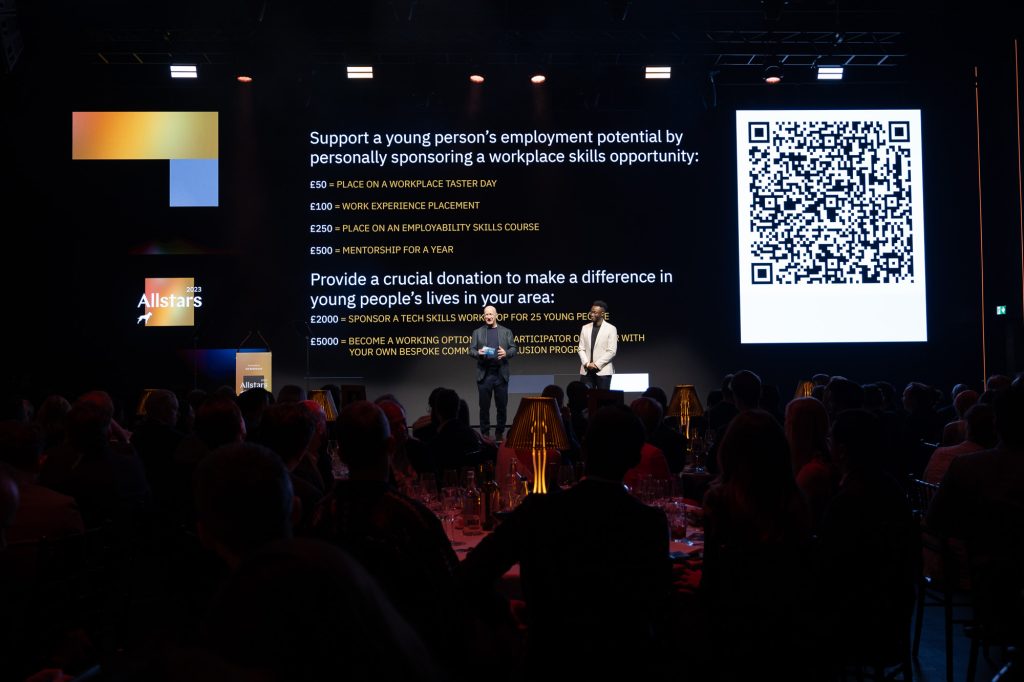

2024 Charity

Allstars is proud to support Working Options in Education. Working Options in Education helps young people fulfil their potential by developing employability and life skills. Our Career Pathways Programme, delivered free with state schools and colleges, supports young people facing additional challenges caused by the pandemic, prioritising those from disadvantaged regions.

The programme includes self-directed online learning; employability and skills masterclasses; talks from industry volunteers; mentoring; business challenges; and access to work opportunities in partner companies.

Since 2010, we have worked to transform the life chances of young people (14-19), by helping them take early control of their education or career journey, when the choices they make will shape their future.

Email Address

fraenze.gade@gpbullhound.com

Phone

+49 15 12 30 42 063

Email Address

sophie.tomlinson@gpbullhound.com

Phone

+44 772 912 0084

ALLSTARS CHARITY FOOTBALL TOURNAMENT

GP Bullhound had the great pleasure of hosting the 2024 Allstars Charity Football Tournament in support of Working Options in Education at the iconic Crystal Palace Stadium, Selhurst Park, on Thursday, 6 June. The event was a tremendous success, featuring exciting matches and appearances by exceptional guests. It was a memorable day filled with camaraderie and support for a worthy cause.

Previous attendees include: Albion VC, Balderton, BlackRock, Blackstone, Eurazeo, FieldHouse, Inflexion, LendInvest, HSBC Innovation Banking, Marriott Harrison, Mayfair Equity Partners, Northzone, Oakley Capital, Orrick, PER, PSG, Taylor Wessing and Vitruvian Partners.

To request more information and sign up your team for 2025, please contact Sophie.Tomlinson@gpbullhound.com

2023 Gallery

2024 Highlights