A new era for the web

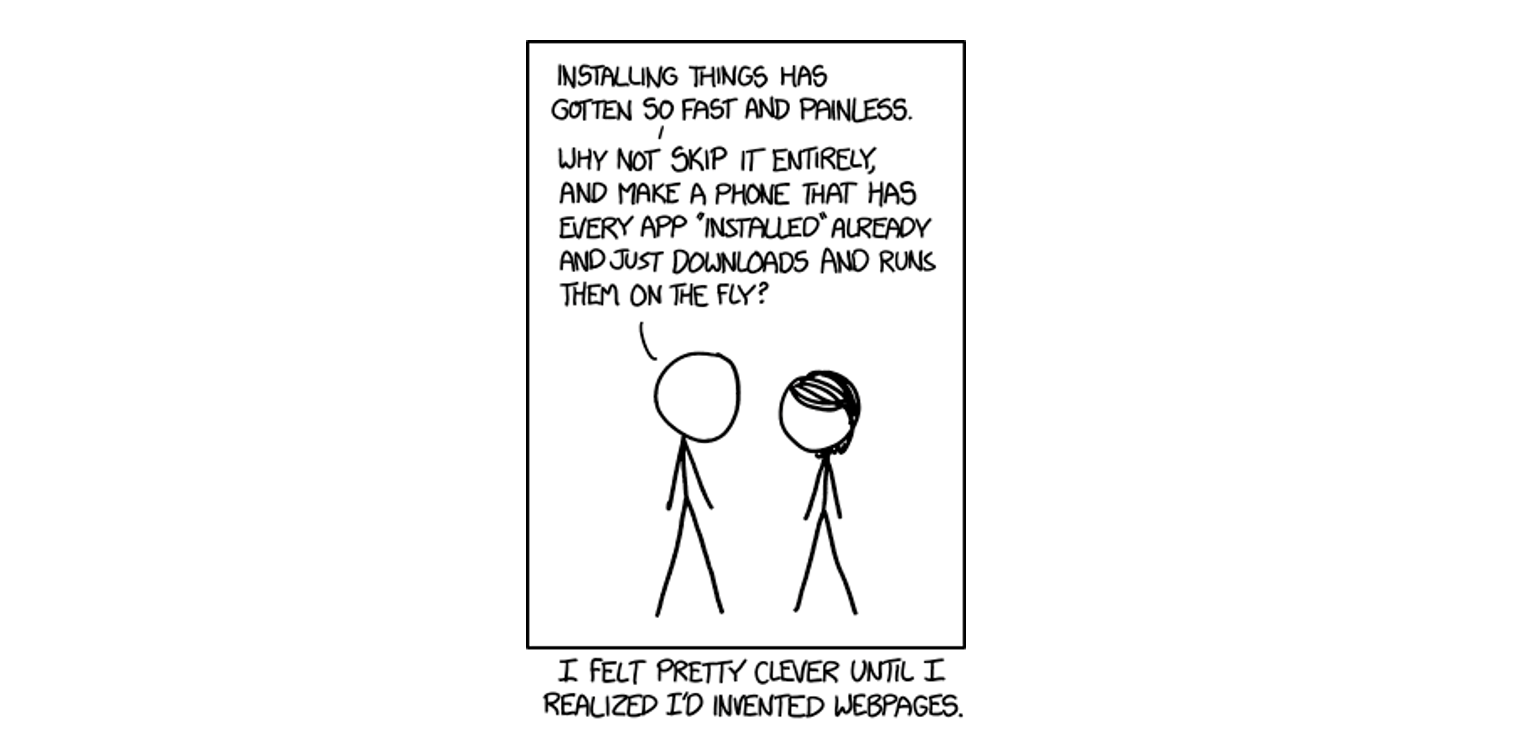

When the comic below was first published in 2014, it depicted an idealised vision of the web. However, this vision has become a reality a decade later. With its websites and web applications, the web platform now has virtually all the capabilities of “native” platforms like Windows or iOS. This software is universally accessible and shareable through a simple URL and browser and can run on any device and operating system from a unified code base. Coupled with its independence from the walled gardens and App Store fees, it’s no wonder the web has emerged as the de facto standard for modern application software development.

The prevalence of the web is evident as we frequently use software like Google Docs, Salesforce, and GitHub through our web browsers. What is less obvious is that many apps, like Slack, Notion, Microsoft Teams, Spotify, and Figma, are all web applications wrapped in a Mac or Windows shell with an added desktop icon to appear native to the platform. Over its three-decades-long legacy, the web has even adapted to platform shifts, with data indicating that nearly 30% of top iPhone apps are built using web technologies and developers using the same technologies to build applications for Apple’s new Vision Pro headset just days after its unveiling last year.

Source: DNIB

Regardless of how the application software landscape evolves, one constant remains: the web continues to grow stronger — the Domain Name Industry report from November 2023 counts 350 million registered website domains. Moreover, the usage of web applications is surging, increasing at a rate of almost twice that of conventional applications. But the most telling indicator of the web’s strength is that nearly 90% all B2B software is now accessed through the web, according to product analytics solution Amplitude, essentially dominating the category.

Almost 90% of B2B software is accessed through the web

However, there’s more to the web’s story than its growth and resilience. Behind the scenes, a transformative shift is underway, with the technologies that have been the backbone of the web for decades now being disrupted by a new generation of categories. The change is exemplified by the decline of Traditional Content Management Systems (CMS) and website builders. WordPress, once powering over a quarter of the top websites on the internet, is experiencing a downtrend in adoption after nearly two decades of dominance. Similarly, its contemporaries, such as Drupal and Squarespace, are following the same trajectory.

Source: BuiltWith

The waning appeal of platforms like WordPress is linked to their original design as comprehensive, all-in-one solutions. This design was highly efficient when the web’s capabilities were more limited. However, today’s web landscape has evolved to favour a more composable architecture, with developers now preferring to build software using an ecosystem of independent systems and components that communicate through APIs. This means they are not bound by the legacy foundation and restrictions of platforms like WordPress, and instead, it allows them to select the best tools for their specific needs.

In practice, this means that all the capabilities WordPress and the likes tried to provide as a monolithic all-in-one package are now being dismantled into specialised tools, each purpose-built for the one use case they replace. For example, we’re witnessing the emergence of Visual Website Builders like Webflow, which concentrate solely on creating websites, unlike WordPress’s combined content management approach. Simultaneously, we see the rise of “headless CMS” like Contentful, focusing exclusively on content management. Furthermore, to serve as the foundation for integrating these components, we see Frontend Cloud Platforms like Vercel gaining significant traction. To reduce the complexity for developers, these platforms provide “Web Development Frameworks”, which are specialised development kits for web applications specifically, with Vercel’s Next.js being one of the most prominent ones.

Looking at the adoption of new web technologies, it’s clear that their popularity is rapidly increasing, particularly among more prominent websites. For instance, the top 10 thousand websites use the Web Development Framework Next.js at a rate four times higher than the top 1 million websites. Similarly, the difference is even more pronounced at fivefold for the headless CMS Contentful.

This disparity in adoption rates can be attributed to the greater resources available to larger companies managing high-traffic websites. They often have more financial resources and access to skilled personnel, enabling them to embrace and implement emerging technologies more readily. This trend is further evidenced by the fact that these leading websites are often the first to phase out older technologies like WordPress.

Source: BuiltWith

However, drawing a parallel with the historical adoption of technologies like WordPress during the height of the “old” web, we observe a pattern where such technologies eventually gained widespread popularity across all websites. If this trend continues, with traditional platforms gradually losing ground, the emerging web technologies and the companies behind them stand to capture a significant opportunity as their markets shift from early adopters to the predominant choice.

Source: GP Bullhound Insights

Enquiries

For enquiries, please contact:

Gustav Fridell, Associate, at gustav.fridell@gpbullhound.com

Sources:

- xkcd, comic “Installing”

- What Web Can Do Today, website

- Evan Bacon, blog post “Who’s using Expo OSS in 2024”

- X (Twitter), tweet by @donadeldev on June 22, 2023

- DNIB, report “The Domain Name Industry Brief Quarterly Report”

- Amplitude, blog post “What’s Growing Faster: Apps or Websites?”

- Amplitude, report “2022 App vs. Website Trend Report”

- BuiltWith, website

- Gartner, report “Top Strategic Technology Trends for 2022”

*No information set out or referred to in this communication shall form the basis of any contract. The issue of this GP Bullhound blog posting (the “report”) shall not be deemed to be any form of binding offer or commitment on the part of GP Bullhound or any of its affiliates or subsidiaries. This report is provided for use by the intended recipient for information purposes only.

It is prepared on the basis that the recipients are sophisticated investors (so-called “professional clients” in the meaning of Annex II of Directive 2014/65/EU on markets in financial instruments, or their equivalent elsewhere) with a high degree of financial sophistication and knowledge. This report and any of its information is not intended for use by private or retail investors in the UK or any other jurisdiction where access, use or availability of this information would be unlawful.

This report does not provide personalized advice or recommendations of any kind. You, as the recipient of this report, acknowledge and agree that no person has nor is held out as having any authority to give any statement, warranty, representation, or undertaking on behalf of GP Bullhound in connection with the contents of this communication. Although the information contained in this report has been prepared in good faith, no representation or warranty, express or implied, is or will be made and no responsibility or liability is or will be accepted by GP Bullhound.

In particular, but without prejudice to the generality of the foregoing, no representation or warranty is given as to the accuracy, completeness or reasonableness of any projections, targets, estimates or forecasts contained in this report or in such other written or oral information that may be provided by GP Bullhound. The information in this report may be subject to change at any time without notice. GP Bullhound is under no obligation to provide you with any such updated information. All liability is expressly excluded to the fullest extent permitted by law. Without prejudice to the generality of the foregoing, no party shall have any claim for innocent or negligent misrepresentation based upon any statement in this report or any representation made in relation thereto. Liability (if it would otherwise but for this paragraph have arisen) for death or personal injury caused by the negligence (as defined in Section 65 of the Consumer Rights Act 2015) of GP Bullhound, or any of its respective affiliates, agents or employees, is not hereby excluded nor is damage caused by their fraud or fraudulent misrepresentation. This report should not be construed in any circumstances as an offer to sell or solicitation of any offer to buy any security or other financial instrument, nor shall they, or the fact of the distribution, form the basis of, or be relied upon in connection with, any contract relating to such action. The information contained in this report has no regard for the specific investment objectives, financial situation or needs of any specific entity and is not a personal recommendation to anyone. Persons reading this report should make their own investment decisions based upon their own financial objectives and financial resources and, if in any doubt, should seek advice from an investment advisor.

Forward-looking information is provided for illustrative purposes only and is not intended to serve as, and must not be relied upon as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and may differ from assumptions. Any and all opinions expressed are current opinions as of the date appearing on the documents included in this report. The information contained in this report should not be relied upon as being an independent or impartial view of the subject matter, and for the purposes of the rules and guidance of the Financial Conduct Authority (“the FCA”) and of Financial Industry Regulatory Authority (“FINRA”), this report shall not be viewed as research report and is considered marketing communication.

Thus, in accordance with COBS 12.2.18 of the FCA Handbook, its contents have not been prepared in accordance with legal requirements designed to promote the independence of investment research and it is not subject to any prohibition on dealing ahead of the dissemination of the report.

The individuals who prepared the information contained in this report may be involved in providing other financial services to the company or companies referenced in this report or to other companies who might be said to be competitors of the company or companies referenced in this report.

For US Persons: This report is distributed to US persons by GP Bullhound Inc. a broker-dealer registered with the SEC and a member of the FINRA. GP Bullhound Inc. is an affiliate of GP Bullhound Corporate Finance Ltd. All investments bear certain material risks that should be considered in consultation with an investors financial, legal and tax advisors. GP Bullhound Inc. engages in private placement and mergers and acquisitions advisory activities with clients and counterparties in the Technology and CleanTech sectors.

In addition, the persons involved in the production of this report certify that no part of their compensation was, or will be, directly or indirectly related to the specific views expressed in this report. As such, no person at GP Bullhound (including its members, directors, officers and/or employees) has received, or is authorized to accept, any inducement, whether monetary or in whatsoever form, in counterparty of promise to issue favorable coverage for the companies to which this report may relate.